Definition

A yield calculation in which bonds are retired routinely during the life of the issue is year-to-average-life. As there are sinking fund requirements therefore, on the open market issuer buys its own bonds. In case of below par bond trading, action results in an automatic price support for the bonds and usually is traded on a yield to average life basis.

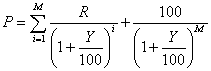

How to Calculate?

If we assume principal portion paid before the maturity date then the yield to average life is the yield to maturity. Its formula is same as yield to maturity whereas M represents the still outstanding bonds for average number of years.

Y = Maturity yield in %.

R = Rate of coupon.

P = Price of the bond

M = the average number of years the bond is outstanding.

The relation is: